What is Negative Gearing?

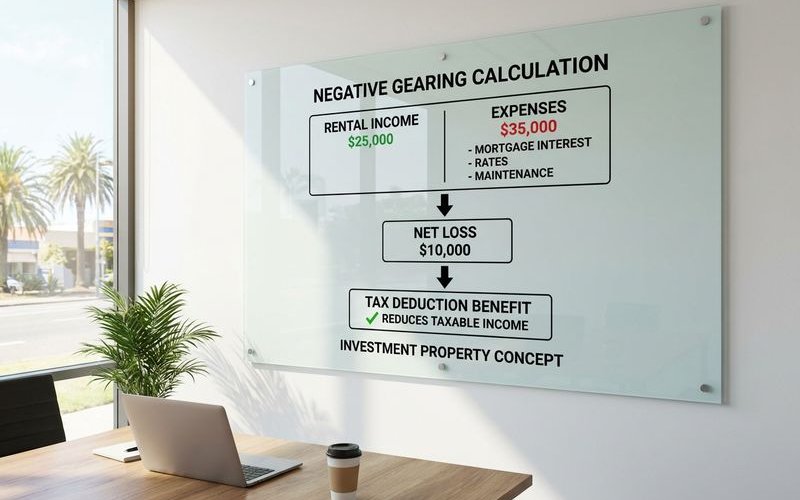

Negative gearing happens when the cost of owning an investment property is higher than the rent it produces. You make a cash loss on the property, but Australian tax law allows you to deduct this loss from your other taxable income, such as your salary or business earnings.

This strategy is used by over 2 million Australian property investors, but it is often deployed incorrectly. The goal isn’t just to pay less tax; it is to hold a high-growth asset that eventually increases in value by more than the money you lost holding it.

How Negative Gearing Works

The Basic Calculation (2025-26 Example)

We’ve updated this calculation to reflect current interest rate environments (around 6.5%) and the 2025-26 tax brackets.

Annual Rental Income: $28,600 ($550 per week)

Annual Expenses:

- Loan interest (6.5% on $500k): $32,500

- Council rates: $3,200

- Insurance: $2,100

- Property management (8%): $2,288

- Repairs/maintenance: $2,000

- Depreciation (Non-cash): $8,000

- Total expenses: $50,088

The Loss: $28,600 income - $50,088 expenses = -$21,488 taxable loss

The Tax Benefit (The “So What”)

Here is where the new “Stage 3” tax cuts matter. If your taxable income is between $45,000 and $135,000, your marginal tax rate is now 30%.

Tax Refund Calculation: $21,488 loss × 30% tax rate = $6,446 tax saved

Your True Out-of-Pocket Cost:

- Cash expenses (excluding depreciation): $42,088

- Cash income: $28,600

- Cash shortfall: $13,488

- Less tax refund: $6,446

- Net cost to hold: $7,042/year or about $135/week

You are effectively paying $135 a week to control a $500,000 asset. If that asset grows by 5% ($25,000) that year, you are ahead by roughly $17,958.

Understanding the Components

Loan Interest

Interest is your biggest deduction, but the Australian Taxation Office (ATO) watches this closely. You can only claim interest on the portion of the loan used to buy the rental property.

The “Apportionment” Trap: If you redraw $20,000 from your investment loan to buy a personal car, you can no longer deduct the interest on that $20,000. This “taints” the loan and requires complex calculations every year. Always keep investment and personal debt structures completely separate.

Depreciation (The “Paper” Loss)

Depreciation is the only deduction where you don’t actually spend cash. It accounts for the wear and tear of the building and its contents.

Building Depreciation (Division 43):

- The Rule: You can claim 2.5% of the construction cost (not purchase price) per year for 40 years.

- Eligibility: Generally applies to residential properties built after September 1987.

- Value: On a property built for $400,000, this is a $10,000 annual deduction.

Plant and Equipment (Division 40):

- The Rule: Covers removable items like carpets, blinds, and hot water systems.

- The Insider Tip: If you renovate an old property, ask a Quantity Surveyor about “scrapping.” This allows you to claim an immediate tax deduction for the residual value of items you throw away (like old carpet) before you replace them.

Getting a Depreciation Schedule: You must hire a qualified Quantity Surveyor (such as BMT Tax Depreciation or Duo Tax) to prepare this report. The cost (approx. $600-$800) is 100% tax-deductible.

Other Deductible Expenses

- Council and water rates: Fully deductible.

- Insurance: Landlord and building insurance.

- Borrowing costs: Loan establishment fees are deductible, but they must be spread over five years or the term of the loan, whichever is shorter.

- Land Tax: Often overlooked by beginners, but fully deductible.

Positive vs Negative Gearing

Many investors start with negative gearing and naturally drift toward positive gearing as they pay down debt and rents rise.

| Feature | Negative Gearing | Positive Gearing |

|---|---|---|

| Cash Flow | You pay money every month (Loss) | You receive money every month (Profit) |

| Tax Impact | Reduces your taxable income (Refund) | Increases your taxable income (Tax Bill) |

| Primary Goal | High capital growth | Passive income stream |

| Risk Profile | Higher (Relies on market growth) | Lower (Self-sustaining) |

Does Negative Gearing Make Sense?

When Negative Gearing Works

You are in a high tax bracket: With the 2025 tax changes, the 37% bracket now kicks in at $135,000, and the 45% bracket at $190,000. Deductions are most powerful here. If you earn $90,000, your benefit is only 30 cents on the dollar, which makes the strategy less effective than before.

You have a cash buffer: A common rule of thumb is to keep 3-6 months of mortgage repayments in an offset account. This protects you if the property sits vacant or interest rates spike.

You are buying in a high-growth area: Losing money every week only makes sense if the property value is skyrocketing. Review long-term growth data from CoreLogic for the specific suburb before buying.

When It May Not Make Sense

You need cash flow now: If you are retiring soon or working part-time, you likely need income, not tax deductions.

The property is a “dud”: Tax savings never compensate for a property that loses value. A 30% or 45% tax refund still means you lost the other 55% to 70% of the money.

Common Misconceptions

”Travel expenses are deductible”

Correction: This changed in 2017. You generally cannot claim travel expenses to inspect, maintain, or collect rent for residential investment properties. Do not let old advice trip you up at tax time.

”I’ll save more tax than I lose”

This is mathematically impossible. You are always losing real money to get a partial refund. You spend $1.00 to get back $0.30 or $0.45. The strategy only works if the property value grows by more than the $0.55-$0.70 you lost.

”Negative gearing is a permanent strategy”

Smart investors view it as a temporary phase. As you pay down the principal and increase rent, your property should eventually become “neutral” and then “positive,” providing you with retirement income.

Calculating If It Makes Sense

Use this checklist to validate your numbers before signing a contract.

- What is the “Cash on Cash” return? Don’t just look at the tax refund. Calculate how much cash you must contribute annually vs. your initial deposit.

- What is the vacancy rate? Check SQM Research for the suburb’s vacancy rate. Anything under 2% indicates a strong rental market where you won’t struggle to find tenants.

- Can you handle a 2% rate rise? Stress-test your repayment ability. If interest rates jumped to 8.5%, could you still cover the shortfall?

- What is the yield? In 2026, a gross yield of 3-4% in a capital city is standard. If it’s lower, the capital growth potential must be exceptional to justify the cost.

Getting the Structure Right

Loan Structure

Interest Only vs. Principal & Interest: Many investors choose “Interest Only” loans for the first 5 years to minimise monthly cash outflows. This maximises tax-deductible interest while keeping your mandatory payments low.

Ownership Structure

Personal Name: Simple and cheap, but offers less asset protection.

Family Trust: Offers excellent asset protection and estate planning flexibility. However, negative gearing losses in a standard Discretionary Trust often get “trapped” inside the trust and cannot be offset against your personal salary. You may need a specific “Hybrid Trust” deed or a different setup to distribute losses.

Record Keeping

Use software to track every cent. Apps or simple spreadsheets must log:

- Rental statements

- Loan interest statements

- Repair invoices

- Depreciation schedules

Gladstone Investment Considerations

The Gladstone market has specific drivers that differ from capital cities like Brisbane or Sydney.

Strong Rental Yields: Recent data indicates Gladstone offers gross rental yields between 5.4% and 6.1%, which is significantly higher than the national average. This higher income reduces the weekly cost of negative gearing.

Vacancy Rates: As of recent reports, vacancy rates in the region have hovered around 1.2% to 1.7%. This is a tight market, meaning well-presented properties rent quickly.

Economic Drivers: The market is heavily influenced by the resources sector (LNG and industrial projects). While this provides high rental demand, it can also create volatility. Investors here should focus on “Capital Works” deductions (Division 43) as many properties are newer builds from the last boom cycle.

Get Investment Finance Advice

Negative gearing is a powerful tool, but it is just one part of the puzzle. You need a finance strategy that accounts for your cash flow, tax bracket, and retirement goals.

Explore our investment property finance options. Book a free consultation to review your borrowing capacity and help you structure your loans to maximise your tax efficiency and safety.

Note: This is general information, not financial or tax advice. Consult a qualified accountant for advice specific to your situation.

Tags

Coral Jacobs

Senior Mortgage Broker at AJ Home Loans Gladstone

Related Articles

Budgeting Tips for First Home Buyers: Building Your Deposit Faster

Practical budgeting strategies to help first home buyers save for a deposit faster while managing everyday expenses.

Buying Property at Auction: A Queensland Buyer's Guide

Complete guide to buying property at auction in Queensland. Understand the process, prepare properly, and avoid costly mistakes.

Should You Get a Car Loan Through a Mortgage Broker?

Discover why mortgage brokers offer car loans, the benefits of using a broker for vehicle finance, and how it compares to dealer finance.