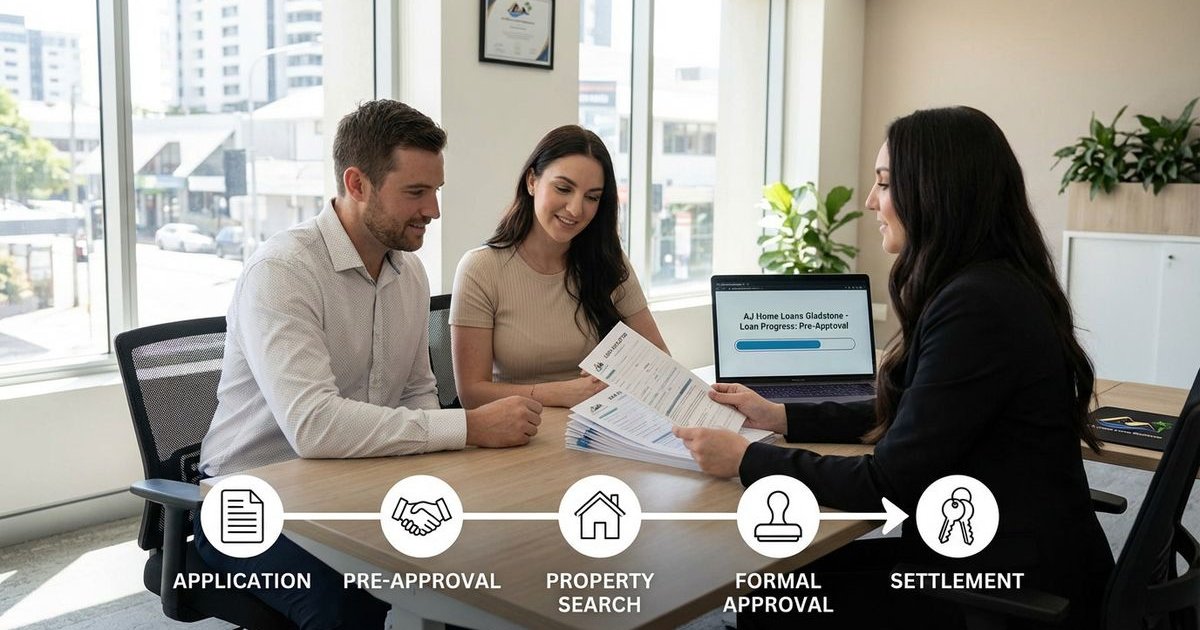

Understanding the Home Loan Process

Understanding what to expect makes the home loan process less stressful. We know that in the current 2026 lending environment, preparation is the single biggest factor in getting a fast approval.

Stage 1: Initial Consultation

What Happens

We meet with you to discuss your property goals, financial situation, and borrowing capacity. Under the Best Interests Duty (BID) legislation, mortgage brokers are legally required to prioritize your interests above their own commissions or lender targets. This is a key distinction between using a broker and going directly to a bank, which is not bound by the same statutory duty to offer you the absolute best product on the market.

What You’ll Need

- Basic income evidence: Recent payslips or business activity statements.

- Deposit details: A clear picture of your savings or equity.

- Purchase budget: A rough idea of your target price range.

Duration

Initial consultation: 30-60 minutes

Outcome

You gain a clear understanding of your borrowing power and which loan options suit your specific needs.

Stage 2: Pre-Approval Application

What Happens

We submit a formal application to verify your borrowing capacity before you commit to a property. This step is critical because it involves the “serviceability assessment,” where lenders test if you can afford repayments at a rate 3.0% higher than your actual interest rate (the current APRA buffer).

What You’ll Need

Identification:

- Driver’s licence

- Passport or Medicare card

- Proof of current address

Income evidence (PAYG):

- Last 2 payslips

- Most recent tax return (sometimes)

- Employment letter confirming position and income

Income evidence (Self-employed):

- Last 2 years’ tax returns

- Last 2 years’ business financials

- Accountant details

Asset and liability information:

- Credit Reporting: Lenders will check your score; a “good” score with Equifax is typically considered 661-734, while anything above 853 is excellent.

- Bank statements (2-3 months)

- Details of other loans

- Credit card statements

- Superannuation balance

Deposit evidence:

- Savings statements showing genuine savings

- Gift letter if receiving family help (Statutory Declaration often required)

- Other deposit sources

Duration

Lodgement: Same day once documents received Assessment: 3-5 business days typically (varies by lender workload)

Outcome

A conditional pre-approval letter stating your maximum borrowing limit, subject to a satisfactory property valuation.

Stage 3: Property Search

What Happens

With pre-approval in hand, you search for a property within your budget. We recommend using tools like Domain or Realestate.com.au to track “days on market,” which can indicate how much negotiating power you might have.

Tips

- Stick to the limit: Your pre-approval has a hard ceiling; exceeding it risks a decline.

- Check conditions: Some property types (like studios under 40sqm or high-density apartments) may not be accepted by all lenders.

- Validity period: Pre-approvals usually last 3-6 months; if yours expires, we must refresh the application with updated payslips.

- Inspections: Always get building and pest reports before bidding or making an unconditional offer.

Duration

Varies - days to months depending on the market and your requirements

Our Role

We remain on standby to answer questions about specific properties you find. A quick call to us before you sign a contract can save you from committing to a property that the lender won’t accept as security.

Stage 4: Making an Offer

What Happens

You make an offer on a property, either through private treaty negotiation or by bidding at auction. Auctions differ significantly because they are unconditional exchanges—meaning there is no cooling-off period and you must pay the deposit immediately.

Cooling-Off Periods by State

Knowing your rights is essential, as laws vary across Australia.

| State | Standard Cooling-Off Period | Penalty for Withdrawal |

|---|---|---|

| NSW | 5 Business Days | 0.25% of purchase price |

| VIC | 3 Business Days | 0.2% of price or $100 (whichever is greater) |

| QLD | 5 Business Days | 0.25% of purchase price |

| SA | 2 Business Days | $100 penalty (usually) |

| All | Auctions have NO cooling-off period | Full deposit at risk |

Important Considerations

- Finance clauses: Always try to include a “subject to finance” clause if buying by private treaty.

- Settlement agent: Have a conveyancer or solicitor engaged before you sign anything.

- Hard limits: Know your absolute maximum price and do not exceed it in the heat of the moment.

Duration

Offer acceptance: Same day to several days of negotiation

Outcome

A signed Contract of Sale, which we will need immediately to progress your loan.

Stage 5: Formal Loan Application

What Happens

We convert your pre-approval into a formal loan application attached to the specific property you have bought. This is where the lender validates that the property is acceptable security and that your financial situation hasn’t deteriorated since the pre-approval.

Additional Documents Needed

- Signed Contract of Sale

- Updated payslips (if the previous ones are older than 14-30 days)

- Updated bank statements showing the deposit is ready

Process

- Lodgement: We submit the full file to the lender.

- Verification: The lender’s credit team reviews the new property details.

- Valuation: An inspection is ordered to confirm the property’s market value.

- LMI Check: If your deposit is under 20%, the Lenders Mortgage Insurance provider must also approve the deal.

Duration

Lodgement: Usually same day as contract receipt Initial assessment: 2-4 business days

Stage 6: Property Valuation

What Happens

The lender orders a valuation to ensure they aren’t lending more money than the property is worth. We see three main types of valuations used in Australia depending on the risk level and location.

Valuation Types

- Desktop/Automated: A data-driven estimate using CoreLogic or similar records (fastest, often instant).

- Kerbside: The valuer drives by to check the exterior condition and neighbourhood.

- Full Inspection: The valuer enters the property to measure rooms and assess the interior condition (required for high-value or unique homes).

Potential Issues

- Shortfall: The valuation comes in lower than your purchase price, meaning you must cover the gap with extra cash.

- Risk ratings: The property is flagged as high-risk (e.g., near high-voltage power lines or in a flood zone).

- Condition: Significant repairs are needed before the lender will accept it.

Duration

Desktop/kerbside: Same day to 48 hours Full inspection: 3-5 business days depending on access availability

If Valuation Falls Short

Options include negotiating a lower price with the seller or paying the difference from your own funds. We can sometimes challenge the valuation with comparable sales data or try a different lender with a more favourable valuer.

Stage 7: Conditional Approval

What Happens

Lender reviews the valuation and all documentation. If satisfied, they issue conditional approval, also known as “formal approval subject to remaining items.”

Common Conditions

- Insurance: A Certificate of Currency showing the building is insured.

- Account closure: Evidence that a specific credit card has been closed (if required for serviceability).

- Deposit trail: Final confirmation of where your funds originated.

Duration

1-3 business days after valuation is received

Our Role

We chase the lender to clear these final conditions immediately. Speed is vital here to ensure you meet your finance clause deadline.

Stage 8: Unconditional Approval

What Happens

Once all conditions are met, the lender issues formal (unconditional) approval. This is the milestone where you can breathe a sigh of relief.

What This Means

- Certainty: The lender is fully committed to funding your loan.

- Clause satisfaction: You can instruct your solicitor to declare the finance clause “satisfied.”

- Binding: The contract is now unconditional, and the deposit is usually released to the seller’s agent.

Duration

1-2 business days after conditions satisfied

Important

Don’t make major financial changes at this stage. Taking out a new car loan or Afterpay debt now can cause the lender to withdraw the offer before settlement.

Stage 9: Loan Documents

What Happens

The lender prepares your loan contract and mortgage documents. Most Australian lenders now issue these digitally for faster processing.

What You’ll Receive

- Letter of Offer: The formal contract detailing interest rates, repayments, and fees.

- Mortgage Form: The legal document registering the bank’s interest on the property title.

- Direct Debit Request: To set up your automatic repayments.

Signing Options

- Digital Signing: Many lenders use secure portals like DocuSign or their own apps.

- Video Verification: Some documents may need a witness via video call.

- Physical Signing: Required by some lenders or for specific state land registries.

Duration

Document preparation: 2-4 business days Signing and return: 1-2 days (instant if digital)

Our Role

We review the offer to ensure the interest rate and loan amount match exactly what was quoted. Mistakes can happen, and it is our job to catch them before you sign.

Stage 10: Settlement Preparation

What Happens

The final steps before the property becomes yours. Your solicitor and the bank’s settlement team coordinate the transfer of funds.

What You Need to Do

- Building Insurance: This must be effective from the date of the signed contract in some states (like QLD) or settlement in others; check with your conveyancer.

- Shortfall Funds: Deposit any remaining cash contribution into your shortfall account.

- Final Inspection: Walk through the property 2-3 days before settlement to ensure it’s empty and undamaged.

Duration

3-7 business days after documents returned

Stage 11: Settlement Day

What Happens

The transaction completes electronically via PEXA (Property Exchange Australia). This digital platform has replaced the old physical room settlements, meaning funds and titles transfer almost instantly.

- Lender: Transfers the loan funds.

- You: Provide any gap funds plus stamp duty.

- Seller: Receives payment and the mortgage is discharged.

- Title: Officially transfers to your name.

Your Role

Usually handled by your conveyancer/solicitor electronically. You do not need to attend; you just wait for the phone call.

After Settlement

- Collect keys: Your agent will release them once they receive the “Order on the Agent.”

- Utilities: Connect your power and internet.

- Celebrate: The home is officially yours.

Duration

Settlement itself: Typically occurs between 11:00 AM and 3:00 PM and takes about 30-60 minutes to clear.

Overall Timeline

| Stage | Typical Duration (2026) |

|---|---|

| Pre-approval | 3-5 days |

| Property search | Variable |

| Formal application to conditional approval | 5-10 days |

| Conditions to unconditional | 2-4 days |

| Documents to settlement | 10-14 days |

| Total from contract to settlement | 4-6 weeks typical |

Timelines vary by lender, property type, and individual circumstances.

Tips for a Smooth Process

Do:

- Disclose everything: Lenders have access to comprehensive credit reporting; hiding a debt will likely cause a decline.

- Stay contactable: Questions often need same-day answers to keep the file moving.

- Maintain the status quo: Keep your spending habits stable and your employment unchanged.

- Review early: Read draft documents as soon as we send them.

Don’t:

- Apply for new credit: A simple enquiry for a store card can drop your credit score and flag a warning.

- Change jobs: Probation periods can be a major hurdle for formal approval.

- Move money around: Large, unexplained transfers look suspicious to credit assessors.

- Spend your buffer: Keep your emergency funds intact until after settlement is confirmed.

How We Help Throughout

As your dedicated broker team, we manage the friction points so you don’t have to. We proactively identify lenders whose policies match your specific situation, preventing potential declines before they happen.

Our team tracks the progress of your application daily. Dealing with bank call centers can be frustrating, so we handle all the follow-up and escalation to ensure deadlines are met.

We communicate directly with your conveyancer and real estate agent. This triangle of communication ensures everyone is aligned on dates and requirements.

Helping you resolve issues quickly is our priority. If a valuation comes in low or a document is rejected, we immediately present solutions to keep the purchase on track.

We keep you informed at every stage. You will never have to guess where your application stands or what happens next.

Ready to Start?

Understanding the process is the first step. The second is getting expert help to guide you through it.

Book a free consultation to discuss your home buying plans and start your journey with confidence.

Tags

Coral Jacobs

Senior Mortgage Broker at AJ Home Loans Gladstone

Related Articles

Budgeting Tips for First Home Buyers: Building Your Deposit Faster

Practical budgeting strategies to help first home buyers save for a deposit faster while managing everyday expenses.

Buying Property at Auction: A Queensland Buyer's Guide

Complete guide to buying property at auction in Queensland. Understand the process, prepare properly, and avoid costly mistakes.

Should You Get a Car Loan Through a Mortgage Broker?

Discover why mortgage brokers offer car loans, the benefits of using a broker for vehicle finance, and how it compares to dealer finance.